What Happens to Workers’ Comp Drug Costs If Section 301 Tariffs Are Applied?

Trade policy is rarely top of mind for workers’ compensation stakeholders. But when tariffs target the pharmaceutical supply chain, the impact does not stay at the border—it shows up in drug pricing, claim costs, and ultimately total program spend.

That raises a practical question for payers, employers, and pharmacy benefit managers:

What is the impact on workers’ compensation drug costs if Section 301 tariffs are applied to pharmaceutical ingredients imported from China and India?

Conducted by Lance Breon, PharmD Candidate, this analysis examines the question using workers’ compensation–relevant generic medications and a transparent, ingredient-level pricing model. The study was accepted for presentation at the ASHP Midyear Clinical Meeting, December 2025.

Why This Question Matters in Workers’ Compensation

Workers’ compensation pharmacy depends heavily on generic medications—particularly for pain, inflammation, and neuropathic conditions. These drugs are often assumed to be stable, low-cost, and insulated from pricing shocks.

However, that assumption breaks down when upstream costs change.

Active pharmaceutical ingredients account for approximately 30–40% of generic drug manufacturing costs, and China and India collectively supply a substantial portion of those APIs. When tariffs are applied at the ingredient level, they exert direct upward pressure on Wholesale Acquisition Cost (WAC) and Average Wholesale Price (AWP)—the benchmarks that underpin WC claim pricing.

Even modest list-price changes can scale quickly across large formularies.

Lance Breon presenting poster at ASHP Midyear, December 2025.

How We Modeled the Impact

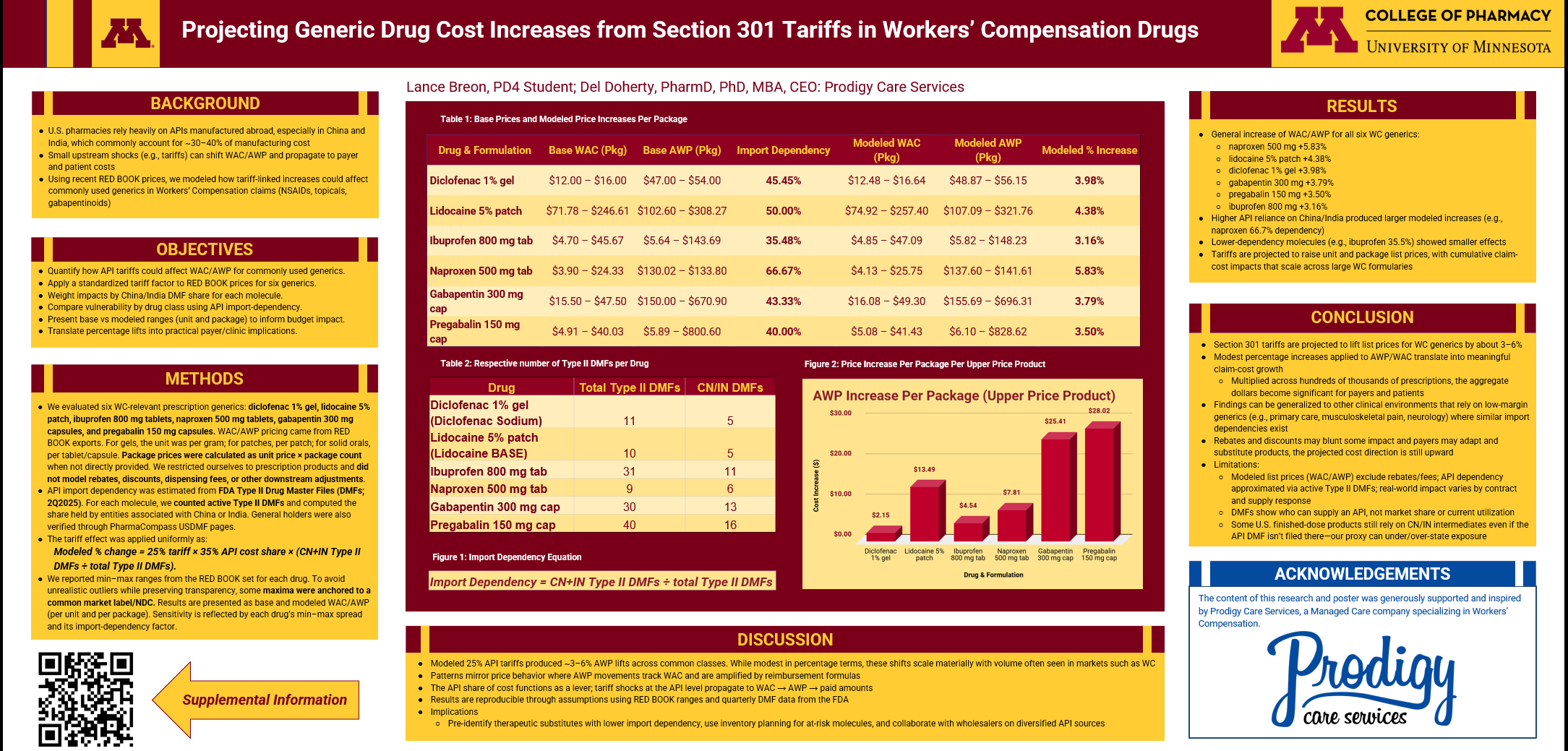

To answer the question, we evaluated six prescription-only generics commonly used in WC claims:

Diclofenac 1% gel

Lidocaine 5% patch

Ibuprofen 800 mg tablets

Naproxen 500 mg tablets

Gabapentin 300 mg capsules

Pregabalin 150 mg capsules

Pricing Inputs

WAC and AWP pricing were sourced from RED BOOK® exports, reported per unit (per gram, patch, tablet, or capsule) and converted to package pricing when needed. Rebates, discounts, and dispensing fees were intentionally excluded to isolate list-price exposure.

Import Dependency

API import reliance was estimated using FDA Type II Drug Master Files (DMFs), 2Q2025, calculating the proportion of active DMFs associated with manufacturers linked to China or India.

Tariff Assumption

We applied a uniform tariff model:

Modeled % change = 25% tariff × 35% API cost share × (China + India DMFs ÷ total DMFs)

This approach ties pricing impact directly to supply-chain concentration.

So—What Happens If the Tariffs Are Applied?

The short answer: list prices go up across the board.

Applying the import-dependency-weighted tariff factor increased WAC and AWP for all six WC generics, with modeled lifts ranging from approximately 3% to 6%.

Modeled percentage increases:

Naproxen 500 mg: +5.83%

Lidocaine 5% patch: +4.38%

Diclofenac 1% gel: +3.98%

Gabapentin 300 mg: +3.79%

Pregabalin 150 mg: +3.50%

Ibuprofen 800 mg: +3.16%

What That Means in Practice

These percentages translate into real dollars at the package level:

Ibuprofen 800 mg (WAC/package):

$4.70–$45.67 → $4.85–$47.09Naproxen 500 mg (WAC/package):

$3.90–$24.33 → $4.13–$25.75Lidocaine 5% patch (WAC/package):

$71.78–$246.61 → $74.92–$257.40

Higher-priced products experience larger absolute increases:

Pregabalin 150 mg:

WAC/package increased from $4.91–$40.03 to $5.08–$41.43

AWP/package rose from $5.89–$800.60 to $6.10–$828.62 (+3.50%)

Why Some Drugs Are Hit Harder Than Others

The key variable is import dependency.

Drugs with greater reliance on China and India for APIs experienced larger modeled increases:

Naproxen showed approximately 66.7% dependency, producing the largest lift.

Ibuprofen, with roughly 35.5% dependency, showed a smaller—but still meaningful—effect.

This suggests tariff exposure is not theoretical—it is drug-specific, measurable, and predictable.

The Answer, in Plain Terms

If Section 301 tariffs are applied to pharmaceutical ingredients:

WC generic drug list prices are projected to increase by ~3–6%

Even modest percentage increases translate into material claim-cost growth at scale

Higher dependency on China and India correlates with greater pricing exposure

Rebates and substitutions may soften—but not eliminate—the upward pressure

These dynamics extend beyond workers’ compensation to any clinical setting that relies on low-margin generics.

Why This Question Should Stay on the Radar

Trade policy is not traditionally viewed as a pharmacy management issue. But as this analysis shows, supply-chain economics increasingly shape claim costs—often in ways that are invisible until after prices move.

For WC stakeholders focused on sustainability, the better question may not be whether tariffs matter—but how prepared your pharmacy strategy is when they do.

By Lance Breon, PharmD Candidate

pharmd@prodigyrx.com

Citations

Pharmacy Benefit Management Institute (PBMI). Trends in Drug Benefit Design Report 2022–2023. Available at: https://www.pbmi.com. Accessed September 2025.

KFF. Prescription Drug Pricing: AWP and WAC Explained. Kaiser Family Foundation. Available at: https://www.kff.org/medicare/issue-brief/prescription-drug-pricing-terms. Accessed September 2025.

U.S. International Trade Commission. APIs and Tariffs from China and India under Section 301 – Investigation No. TA-131-047. Available at: https://www.usitc.gov. Accessed September 2025.

U.S. Food & Drug Administration (FDA). Drug Master Files (DMFs) – Type II API Registrations. Available at: https://www.fda.gov/drugs/drug-master-files-dmfs. Accessed September 2025.

Workers Compensation Research Institute (WCRI). Prescription Drug Trends – 2023 Update. Available at: https://www.wcrinet.org. Accessed September 2025.

National Council on Compensation Insurance (NCCI). Prescription Drug Research Briefs and Drug Trend Updates. Available at: https://www.ncci.com. Accessed September 2025.

ASHP. ASHP Drug Shortages Database. American Society of Health-System Pharmacists. Available at: https://www.ashp.org/Drug-Shortages. Accessed September 2025.

U.S. Food & Drug Administration (FDA). Essential Medicines Supply Chain and Manufacturing Resilience Report. October 2022. Available at: https://www.fda.gov. Accessed September 2025.

IBM Micromedex RED BOOK. AWP and WAC Pricing Database 2024–2025. IBM Watson Health. Accessed September 2025.

IQVIA Institute. The Use of Medicines in the U.S. 2023: Usage and Spending Trends and Outlook to 2027. IQVIA. Available at: https://www.iqvia.com. Accessed September 2025.

National Council on Compensation Insurance (NCCI). The Medical Dilemma of Prescription Drugs in Workers Compensation. Available at: https://www.ncci.com/SecureDocuments/AES_Content/Medical_Dilemma_Rx.html

Workers Compensation Research Institute (WCRI). Interstate Variation and Trends in Workers’ Compensation Drug Payments, 5th Edition. Available at: https://www.wcrinet.org/reports/interstate-variation-and-trends-in-workers-compensation-drug-payments-5th-editiona-wcri-flashreport

National Council on Compensation Insurance (NCCI). Workers Compensation Drug Fee Schedule. 2017. Available at: https://www.ncci.com/Articles/Pages/II_2017_workers_comp_drug_fee_schedule.pdf

Brookings Institution. Pharmaceutical Tariffs: How They Play Out. Available at: https://www.brookings.edu/articles/pharmaceutical-tariffs-how-they-play-out

AIMS International. The Massive Potential of the US API Pharmaceutical Manufacturing Market. Available at: https://www.aimsinternational.com/news/the-massive-potential-of-the-us-api-pharmaceutical-manufacturing-market

Congressional Research Service. CRS Insight IF11346: U.S. Active Pharmaceutical Ingredient (API) Manufacturing and Supply Chain. Available at: https://www.congress.gov/crs-product/IF11346

Healthesystems. High Prices, High Impact: Meet the Drugs Driving Up Claim Costs in Workers’ Comp. Available at: https://healthesystems.com/rxi-articles/high-prices-high-impact-meet-the-drugs-driving-up-claim-costs-in-workers-comp/

Healthesystems. Myth Busters: Private Label Topicals Edition. Available at: https://healthesystems.com/rxi-articles/myth-busters-private-label-topicals-edition/

Pharmaoffer. Diclofenac API Suppliers. Available at: https://pharmaoffer.com/api-excipient-supplier/nsaids/diclofenac/

Pharmaoffer. Lidocaine Hydrochloride API Suppliers (India). Available at: https://pharmaoffer.com/api-excipient-supplier/local-anesthetics/lidocaine-hydrochloride/india

Pharmaoffer. Lidocaine Hydrochloride API Suppliers (China). Available at: https://pharmaoffer.com/api-excipient-supplier/local-anesthetics/lidocaine-hydrochloride/china

Pharmaoffer. Ibuprofen API Suppliers. Available at: https://pharmaoffer.com/api-excipient-supplier/nsaids/ibuprofen

Pharmaoffer. Naproxen API Suppliers. Available at: https://pharmaoffer.com/api-excipient-supplier/nsaids/naproxen/

U.S. National Library of Medicine (NLM). RxNorm Source Release Documentation: MediSpan Master Drug Data Base (MMX). Available at: https://www.nlm.nih.gov/research/umls/rxnorm/sourcereleasedocs/mmx.html

Enlyte. Gabapentinoids in Workers’ Compensation. Available at: https://www.enlyte.com/insights/article/pharmacy-benefit-management/gabapentinoids-workers-compensation

National Council on Compensation Insurance (NCCI). Workers Compensation Prescription Drug Research Brief. 2018. Available at: https://www.ncci.com/Articles/Documents/Insights_ResearchBrief_WC_Prescription_Drugs-2018.pdf

Pharmaoffer. Gabapentin API Suppliers. Available at: https://pharmaoffer.com/api-excipient-supplier/anticonvulsants/gabapentin

Pharmaoffer. Pregabalin API Suppliers. Available at: https://pharmaoffer.com/api-excipient-supplier/anticonvulsants/pregabalin